Over

000

active

relationships

000

Clients with us

for more than 20 yrs

Worked with more than

0

of NIFTY 500

companies

Over

transactions done by

clients annually

Market Indicators

Market Indicators

| Today | 1 Day ago | 1 Week ago | 1 Month ago |

|---|

Updated on 09 Jan, 2026 17:29

Latest Articles

Our Approach to Risk Management

Having advised nearly 5,000 companies over the past 40+ years, we have learned a few critical things about risk management. Each company – and its needs – is unique in terms of its business model, margins, risk appetite, balance between managing cash and managing the accounts, and the management’s general philosophy on risk management. Based on our understanding of these factors we articulate a customized risk management approach for each client which rests on three pillars.

Risk Identification

Know your risk

If the objective is to manage cash flows, Treasury must identify risk out to the longest meaningful tenor, building in elements like the frequency of changes in pricing, the possibility

Read MoreRisk Measurement

Define your boundaries

Once the risk is identified, it is important to define the worst acceptable rate for each exposure – set a ‘Risk Limit’. This risk limit should be set keeping in mind

Read MoreRisk Monitoring and Hedging

Follow a hedge strategy that is not totally dependent on market views

One of the truisms of markets is that it doesn’t matter who you are, how smart you are, or how much experience you have, the market will get the better of you over any reasonable

Read MoreIn addition to providing regular advisory services, we have built and implemented such hedging models for nearly 100 companies over the past 5 years. | |

For implementing this approach, we offer ‘hands-on’ Treasury Middle-office support, where we are responsible for, |

|

|

|

We can also outsource front office execution, based on a customized Mecklai-client technology interface with strong, integrated MIS, and take complete responsibility for a client’s FX risk management function to consistently deliver agreed performance benchmarks. |

|

Subscription Benefits

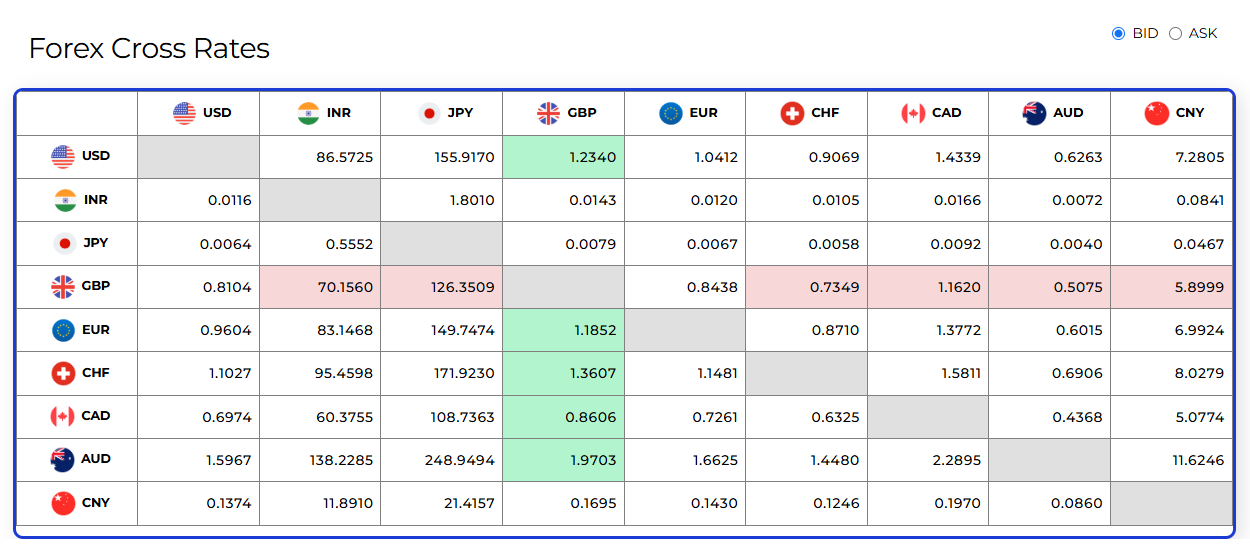

| Forex Cross Rates |

| Global Economic Calendar |

| Forward Rate Calculator |

| Historical Spot Rates |

| Daily FX Trends |